Background

Establishing a business in China is not as straightforward as most overseas investors into China initially anticipate and the process comes with its own unique challenges and complexities. The actual legal and administrative preparation for the setting up of a business can be a very time consuming task if professional guidance isn¡¯t sought. Multiple government bodies are involved in the process and the overall procedure can take anywhere from two to even as long as nine months depending on the type of entity that needs to be established and proper compliance with the procedural elements being met. Additionally, due to changes in legislation, the most efficient forms of business structure will vary over time and from situation to situation making the environment for corporate establishment fluid.

This guide to setting up a company in China will provide an overview of the key benefits of each entity and provide best practice guidance on the processes involved for establishing a PRC entity.

Understanding the Corporate Environment

Prior to setting up a Permanent Establishment ("PE"), an investor needs to understand clearly their model for business in China and answer the following key questions which would include:

What are the specific business objectives for the Chinese market and is establishing a legal entity the appropriate course of action at the given time?

-What type of legal entity would be the optimal operational vehicle for conducting compliant business practice?

-What will the Business Scope of the business be?

-How will the company be capitalised, financed and structured?

-Who are the target clients / customers and how does the business intend to find and service them?

-What is the future level of scope for the business (i.e.: will it be a large expanding business or a small localised one serving niche markets?

-What is the level of control that the parent company expects to exercise over their company?

-Will the business be resourced solely by hiring local employees or are there plans to hire expatriate staff?

-Will the company need to take China ¨C Sourced revenue?

-Will revenue need to be repatriated back to the Head Office jurisdiction?

-Will the scope of business require any further governmental pre-approvals?

All of these questions will enable an investor in China to identify the type of entity that they wish to establish, as well as ensuring that the foundations for the company¡¯s long-term sustainability in China are set. If a company is not structured robustly from the outset it can become a frustrating, time consuming and costly process to restructure accordingly, switch tax jurisdiction or amend the business scope.

Types of Permanent Establishment for FIEs

There are specific options for establishing Limited Liability Companies ("LLC") in the PRC which are listed below. Each type of entity has its own advantages to the investor depending on circumstances for the proposed business¡¯ modus operandi:

-Wholly Foreign Owned Enterprise ("WFOE")

-Representative Office ("RO")

-Joint Ventures ("JV") ¨C Cooperative Joint Venture ("CJV") and Equity Join Venture ("EJV")

Setting up a Wholly Foreign Owned Enterprise ("WFOE")

A WFOE is 100% foreign-owned and provides greater control over the business for a foreign investor in China. Establishing a WFOE is the most common investment vehicle for FIEs to operate commercially in Mainland China. They are limited-liability corporations that are established by foreign nationals and capitalised with foreign funds in order to maintain control.

Compared to the other structures, a WFOE is the only entity whereby a foreign owner can retain 100% control. WFOE are often used to produce the foreign firm¡¯s product in Mainland China for later export to a foreign country. The registered capital of a WFOE should be subscribed and contributed solely by foreign investors. A WFOE does not include branches established in China by foreign enterprises and other foreign economic organisations.

There are mainly three types of WFOE available for establishment:

-Service / Consulting

-Trading ¨C Also known as a Foreign Invested Commercial Enterprise ("FICE")

-Manufacturing

Historically due to a WFOE¡¯s mandatory adherence to the foreign invested enterprise law ("FIE Law") creating an irregular playing field for foreign companies in the PRC, there have been a number of regulatory restrictions placed on WFOEs. For example when applying for registration, a WFOE must carefully define the "Business¡¯s Scope" of the business activities that it will engage in. Technically speaking, once the business scope has been established, a WFOE can only legally engage in activities as outlined under the terms of the business scope registered with and authorised by the Administration of Industry & Commerce ("AIC") and as defined on the business license. Examples of a WFOE business scope would define provision of services within for example, the areas of Consulting, Marketing, Manufacturing or Corporate Management.

However, the terms of the FIE Law do not apply to WFOE Branches or Representative Offices ("RO") owned by foreign enterprises. Recently there has been relaxation by the Chinese authorities of the regulations for WFOE companies centred around minimum capital registered, working capital requirements and the alleviation of the Company Organisation Code Certificate stage of registration. While the cost to establish a WFOE remains relatively high when compared to a Domestic Company, a WFOE is still regarded as the most attractive business structure option for investing into China from overseas.

Advantages of Establishing a WFOE

The advantages of setting up a WFOE in China include the ability to uphold a company¡¯s global strategy free from interference, maintain total management control within the limitations of PRC laws, the ability to receive and dispatch RMB to the parent company overseas, increased protection of trademarks and intellectual property, and shareholder liability limited to the original investment.

Setting up a WFOE in China takes between 2 to 9 months depending upon the scope of business and can consists of a many steps and procedure. ¡®The Registered Capital¡¯ is the amount required to cover the company costs for the first one to two years (e.g. salary, rental fees, operational costs, equipment, travel expenses) and run the business until it breaks even. The Chinese Company Law provides that the minimum registered capital should be as determined by the shareholders and the board, and a minimum of RMB1. However, if practice the Government normally reviews that the suggested amount is sufficient to cover the working capital of the business, and they will suggested minimum registered capital, examples being; a Service, IT, or Consulting WFOE is between 100,000 to 300,000 RMB (approx. USD$ 50,000 or Euro 35,000), for trading and manufacturing, the suggested minimum amount of registered capital is USD 80,000.

WFOE Compliance

In general, a WFOE will have to register and comply with multiple regulatory bodies and these are set out below:

-Administration for Industry and Commerce ("AIC")

Company name registration and business licence.

-Ministry of Commerce or Foreign Economic Cooperation Bureau

Business approval documents.

-Public Security Bureau ("PSB") / Seals Office

Issuance of Chops (Company Chop, Contract Chop, Finance Chop).

-Local & State Tax Bureau

Registration of company information

-Other Governmental Departments as Required

Registration of company information as required

Guidelines on Registered Capital

When registering a WFOE, the authorities require the company to have a sufficient sum of registered capital injected at the outset to ensure that the business can sustain itself for a period as such until there is sufficient cash flow for operations. The exact sum of registered capital required for an organisation would vary depending on the sector, business scope and business plan.

The Process

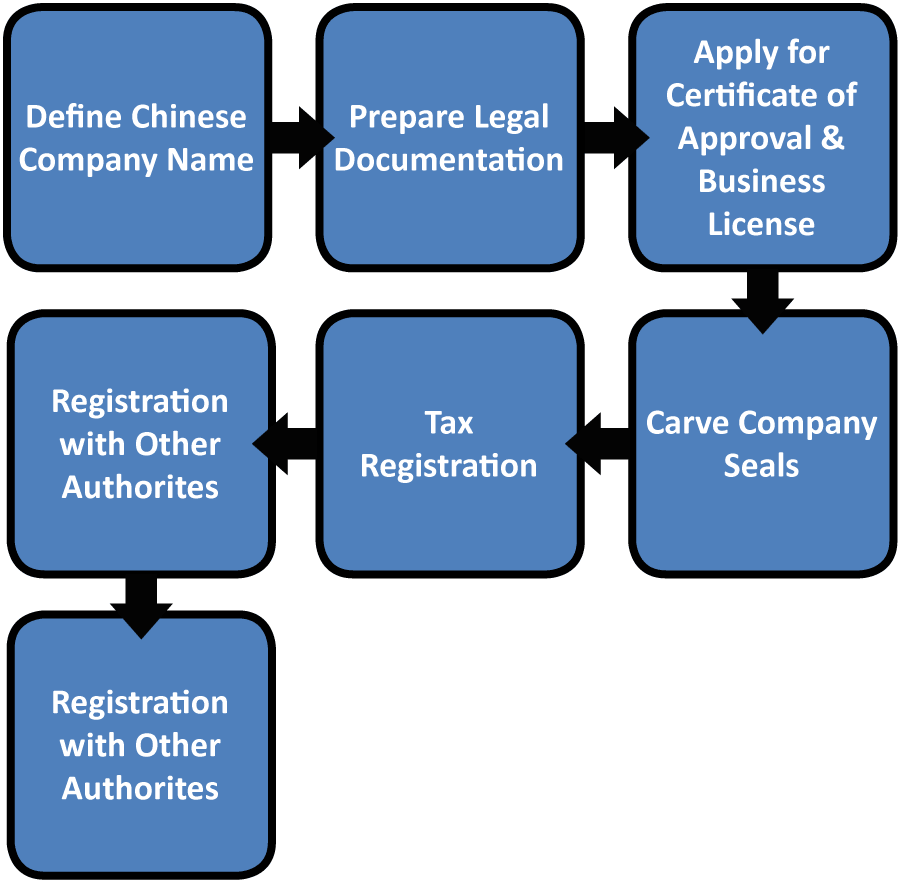

The steps to setting up a WFOE are to:

File your official Chinese business name.

Ensure that all important documents are drafted in Chinese for the company registration at the correct location.

Apply for Certificate of Approval and Business License at the local authorities.

Once you receive the license, register for taxes at the State and Local Tax Bureau.

Register the business at any other relevant authorities.

Open a Foreign Currency and Chinese RMB bank account.

The following flow chart illustrates the procedure for setting up a WFOE in China:

Representative Office ("RO")

A Representative Office, or Rep Office ("RO"), is an office established by a company to conduct non-profit practices, such as marketing and other non-transactional operations in a foreign country. Companies in foreign locations use Rep Offices for the use of sourcing of products and perform as a connection between the head offices and rep offices in other countries.

This type of office allows a company to show its commitment to the new market while permitting more intense on-the-ground research and is the most common form of foreign entity in China. Rep Offices cannot regularly buy, sell or offer services pertaining to a company, but however, have the ability to contact consumers and enter into contracts on the company¡¯s behalf. Rep Offices are also not allowed to represent any other firm other than it¡¯s parent enterprise, collect or issue invoices within China¡¯s products/services, and buy property or import production equipment. Guidelines for Establishing an RO

The advantages of Rep Offices are that they are cost efficient, require no minimum capital investment or business plan, are easy to control, quick to set up, and are relatively inexpensive. The disadvantages of rep offices are that they are limited in the nature of business activities involving consumer and profit-making engagement plus they cannot employ staff directly and they must use an authorised human resources agency in order to hire staff.

A representative office in China may only engage in non-profit making activities and can carry out the following functions:

Conduct research and survey for its parent enterprise in the local market.

Liaise with local and foreign contacts in China on behalf of the parent enterprise.

Conduct research and provide data and promotional materials to potential clients or trading partners.

Act as a coordinator for the parent enterprise¡¯s activities in China.

Make travel arrangements for parent enterprise representatives and potential Chinese clients.

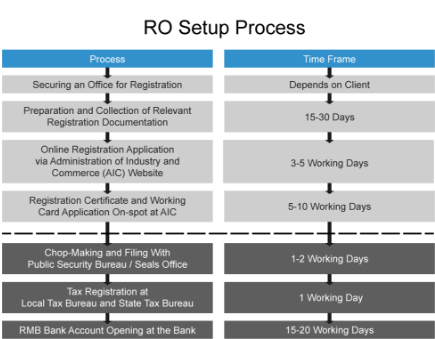

A Rep Office takes less time generally to establish than any other business entities for FIEs in China and the process is illustrated below:

Joint Venture ("JV")

A Joint Venture ("JV") is a business arrangement in which two or more parties agree to combine their resources for the purpose of accomplishing a specific task. A Chinese party and a foreign party merge their resources and expertise to reduce the exposure of risks from other businesses and to create new business projects or activities. Participants in a JV are responsible for their management, profits, losses, and all costs associated. However, the business is deemed as a separate entity, apart from the other participant¡¯s benefits.

There are 2 types of joint ventures:

1.Equity Joint Venture ("EJV")

An EJV is an independent legal entity with limited liability. Profit and risk sharing in an EJV are proportionate to the equity of each partner in the EJV.

2.Contractual (Cooperative) Joint Venture ("CJV")

A CJV¡¯s profits are allocated according to the terms of the co-operative venture contract rather than the proportion of their input in the registered capital, which offers greater structural flexibility over an EJV.

Joint Ventures are sometimes the only way to register in China if a certain business activity is still controlled by the government or restricted for foreign investors. In certain industries, the Chinese shareholder should hold the majority equity stake.

Guidelines for Entering into a JV

The advantages of setting up a JV in China are the existing relationships already in China, existing distribution and sales channels, the better ability to enter into industrial sectors that WFOEs are excluded from. The disadvantages can include sharing profits with a Chinese partner, conflicting interests in management and risks with Technology Transfer and Intellectual Property Management.

Utilising Free Trade Zones ("FTZs") & Designated Hi-Tech Zones

Since the Free Trade Zone was formally announced in Shanghai on 29th September 2013, three other FTZs have been established (Guangdong, Tianjin and Fujian) with the goal of attracting foreign investment from major Multinationals ("MNCs"). The more liberalised Free Trade Zones ("FTZ") enable WFOE establishment as a practical solution for FIEs. Companies in FTZs are able to exercise additional autonomy over their business and receive certain tax incentives. Additionally there are more sectors that companies can operate in although a negative list system clarifies sectors that a WFOE cannot operate in or requires special permissions in which to operate. This list has decreased significantly from over 190 to just 139 in 2014 and continues to streamline in order to open investment into the FTZs.

Other zones that are attractive are high-technology parks/zones, processing zones and logistics parks. The Go West and Go North policies will likely be encouraged through the 13th Five Year Plan (¡°FYP¡±) plan and the Belt & Road Initiative (¡°BRI¡±) will also create a favourable environment for companies expanding into or setting up in these territories. These are all regions that offer region specific incentives that make operating specific styles of business in their respective areas attractive.

In Summary

China continues to open up industries and to make it easier for foreign companies to establish operations in China and to conduct business. This process of opening up and reduction of red tape is a continuum and companies are advised to therefore follow developments and to review where their operations should be located, the type of entities to be used, their scope of business and capital required in their China businesses.

For more resources on Establishing a company in China, please contact us at jack@86startup.com